In today’s world, convenience is king. Whether you’re eyeing a new smartphone, upgrading your home appliances, or buying festival gifts, online shopping has become the go-to method for millions of Indians. But with rising prices and the urge to not drain one’s savings in one shot, more consumers are turning to an increasingly popular solution—shop on EMI using instant personal loan apps.

Gone are the days when owning the latest gadget or furnishing your home required months of savings or reliance on traditional bank loans. With the rise of digital lending platforms, getting access to credit is faster, easier, and more seamless than ever before. This change has opened up a world of possibilities, especially for those who want flexibility without compromising their financial comfort.

The New Face of Online Shopping: Flexibility First

The idea of splitting payments into monthly instalments isn’t new, but what’s changed is who can access this facility. Traditional EMI options were often restricted to credit card users, leaving out a large segment of buyers who either didn’t qualify for a credit card or preferred to avoid them. But now, instant personal loan app solutions have democratised access to EMIs.

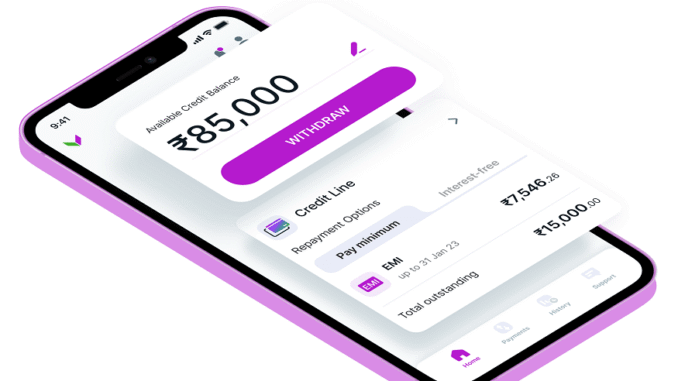

These apps allow users to quickly apply for small to medium-ticket loans—sometimes in minutes—and then use the funds to make purchases from popular online marketplaces. The money gets transferred to the user’s bank account, and from there, it can be used for any transaction, including shopping. This means you’re no longer tied to EMI options offered only at checkout—you have more control, flexibility, and choice.

How Instant Personal Loan Apps Make EMI Shopping Easy

When you use an instant personal loan app, the process typically begins with a simple online application. Unlike banks that often ask for a stack of paperwork, these platforms use modern underwriting techniques like credit bureau data, bank statements, and digital KYC to process applications. In most cases, the approval process is lightning fast, and funds are disbursed almost instantly.

Once the funds are in your account, you can choose what to buy, where to buy from, and how much to spend. Want to buy a new washing machine during a festive sale? Need to urgently replace your work laptop? With EMI shopping via these apps, there’s no need to wait for that salary credit or drain your emergency fund.

Moreover, repayment is structured into fixed monthly instalments, which makes it easier to plan your finances. Most apps offer tenures ranging from 3 months to 24 months, depending on the loan amount and the user’s repayment capability. The best part? There’s no pressure to buy from a specific retailer or wait for special bank tie-ups.

Why More Indians Are Choosing to Shop on EMI This Way

The appeal of shop on EMI facilities powered by instant personal loans lies in the freedom and ease they offer. Many users, especially those in tier 2 and tier 3 cities, are embracing this model because it gives them purchasing power without jumping through hoops.

There’s also a psychological comfort in knowing that large expenses can be broken down into bite-sized, manageable payments. Rather than putting off a much-needed purchase, people can fulfil their needs immediately and pay over time.

In a country where festive spending, gift-giving, and family responsibilities often come together, this kind of financial flexibility is a game-changer. It empowers individuals without encouraging reckless spending, as most apps now come with features that help users track repayments, set auto-debits, and receive reminders.

The Credit Card Alternative That’s Gaining Ground

For years, credit cards were the only ticket to EMIs. But with a large chunk of India’s population being credit invisible or lacking access to plastic money, many felt left out. That’s where instant personal loan app solutions stepped in to fill the gap.

These apps don’t require a credit card and often cater to first-time borrowers. Some even extend credit to people with thin credit files or irregular income, provided they meet basic eligibility criteria. By making credit accessible and transparent, they’ve become a preferred choice for students, gig workers, freelancers, and small-town salaried individuals alike.

And since the loans are typically unsecured, there’s no need to pledge any asset or provide a guarantor. This means even those just starting their careers or setting up a household can confidently make purchases without waiting for years to build a financial history.

What to Keep in Mind Before You Shop on EMI

While the freedom to spend now and pay later is attractive, it’s important to use these facilities responsibly. Every instant personal loan app comes with its own terms—interest rates, processing fees, repayment tenures, and penalties for late payments.

Before applying, take the time to understand the total cost of the loan. A zero-cost EMI might sound appealing, but often the interest is built into the product price. In contrast, instant personal loan apps usually offer transparent pricing with clear interest charges. This allows you to compare and choose wisely.

Also, ensure that your monthly EMI fits comfortably within your budget. Missing payments can impact your credit score and lead to penalties. That said, many platforms also allow part-prepayments or foreclosure without extra charges, which can help save on interest if you’re financially ahead of schedule.

Real-Life Scenarios Where EMI Shopping Makes Sense

Consider a young professional who just moved to a new city and needs to set up their apartment. Buying a fridge, a bed, and a washing machine in one go might feel overwhelming. Instead of draining all savings or taking help from family, they can turn to an instant personal loan app and shop on EMI to furnish their home with ease.

Or take a student who needs a reliable laptop for coursework. Instead of compromising on quality due to limited funds, they can break the cost into affordable monthly payments.

Even for families planning big-ticket purchases during Diwali or wedding season, this route offers a cushion. Whether it’s a smart TV for the living room or gold jewellery for the bride, splitting payments helps preserve liquidity without putting celebrations on hold.

Final Thoughts: Freedom, Convenience, and Smarter Spending

Shopping is no longer just about what you want—it’s about how you pay for it. With instant personal loan app solutions, consumers are no longer bound by rigid banking rules or dependent on credit cards. The ability to shop on EMI with minimal paperwork and instant approval has redefined how Indians approach spending.

This model champions convenience without compromising financial discipline. As long as the buyer understands the repayment obligations and borrows within their means, EMI shopping can be a fantastic tool to improve lifestyle, manage cash flow, and enjoy what they need—when they need it.

The digital credit revolution is here, and it’s putting purchasing power directly into the hands of everyday Indians. Whether you’re buying essentials, gadgets, or festive must-haves, remember—you don’t need to pay all at once. Smarter shopping is just a tap away.

Leave a Reply

You must be logged in to post a comment.