Throughout history, few things have been as universally recognized and reliable as gold. People turn to gold when they’re worried about things like inflation, economic problems, or conflicts. But for those used to buying and selling stocks and bonds online, getting into gold can be tough. Unlike digital assets, buying gold means dealing with real people and figuring out where to store it safely. It’s a different game that requires careful planning and understanding to do it right.

The primary avenues for investing in physical gold include bullion, coins, and jewellery, each with its own set of considerations and potential pitfalls.

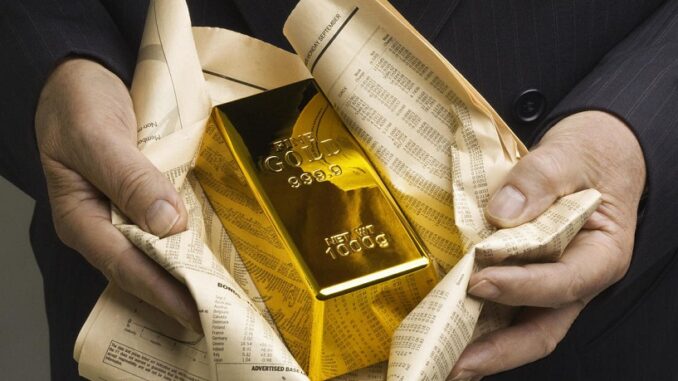

Gold Bullion Bars

Bullion, typically envisioned as large, gleaming bars securely housed in vaults, offers a straightforward means of gold ownership. These bars come in various sizes, ranging from a few grams to a substantial 400 ounces, with one- and ten-ounce bars being the most prevalent. However, given the substantial price of gold, investors must exercise caution, ensuring they engage with a reputable gold dealer and arrange for secure delivery or storage to protect their investment.

Gold bullion coins

Gold coins offer a simpler way of investing in precious metals. You can find them in different sizes, like one or two ounces, and some gold dealers even have smaller ones, like half-ounce or quarter-ounce coins. Coins such as South African Krugerrands, Canadian Maple Leafs, and American Gold Eagles are well-known and easy to trade. But their prices might not only depend on how much gold they have.

Collectible coins, in particular, often command premiums above their gold content due to factors like rarity and historical significance. Therefore, it’s crucial for investors to carefully consider their options before making a purchase. While local markets or collectors may offer potentially better deals, the security provided by dealing with licensed dealers cannot be overstated.

Gold jewellery

Investing in gold jewellery introduces an additional layer of complexity and risk compared to bullion or coins. While wearable gold jewellery holds intrinsic value and aesthetic appeal, investors must exercise caution to ensure authenticity and purity. Unlike bullion or coins, where the value is primarily determined by the gold content, jewellery prices may include significant mark-ups based on design and manufacturer, potentially exceeding three times the raw value of the gold. Understanding the purity of the jewellery, typically measured in karats, is essential, as lower purity levels diminish the jewellery piece’s melt value.

While gold jewellery can be a form of investment, it’s not always the most efficient one. It’s wise to consider diversifying your investments beyond just physical assets like gold jewellery.

In conclusion, investing in physical gold offers investors a unique opportunity for diversification and protection against economic uncertainty. Whether through bullion, coins, or jewellery, individuals must carefully weigh the benefits and risks associated with each option. While gold has historically served as a safe haven asset in times of turmoil, thorough research, engagement with reputable gold dealers , and a nuanced understanding of pricing, purity, and storage considerations are imperative for success in the physical gold market. By navigating these complexities effectively, investors can potentially capitalize on gold’s enduring allure while safeguarding their financial future against turbulent times.

Leave a Reply

You must be logged in to post a comment.